Wild Rye

Premium Performance Apparel for Women & Kids

Building the next great outdoor brand, designed for women and families from the ground up. Wild Rye is a women-founded, mission driven outdoor apparel brand designing technical performance wear specifically for women, a historically underserved market.

Wild Rye Products

What should we know about the products in your store? Better descriptions result in more sales.

From The Founder

Hi, I’m Cassie Abel, founder & CEO of Wild Rye. I’m a former All American lacrosse player turned adventure athlete. After 15 years in the outdoor industry, I got tired of squeezing into gear that didn’t fit, and being told “women won't invest in high end gear.” I knew that wasn't true and that the industry was ignoring nearly half the market, so I launched Wild Rye, now a certified B Corp, to prove them wrong.

Wild Rye is the leading technical outdoor apparel brand 100% founded, led, and built for women. We design bold, beautiful gear that actually fits, performs, and looks good, because we are our customer. Our all-women team lives the lifestyle, knows what’s missing, and builds what women really want.

Investment Dashboard

Brand Overview:

Key Investment Stats

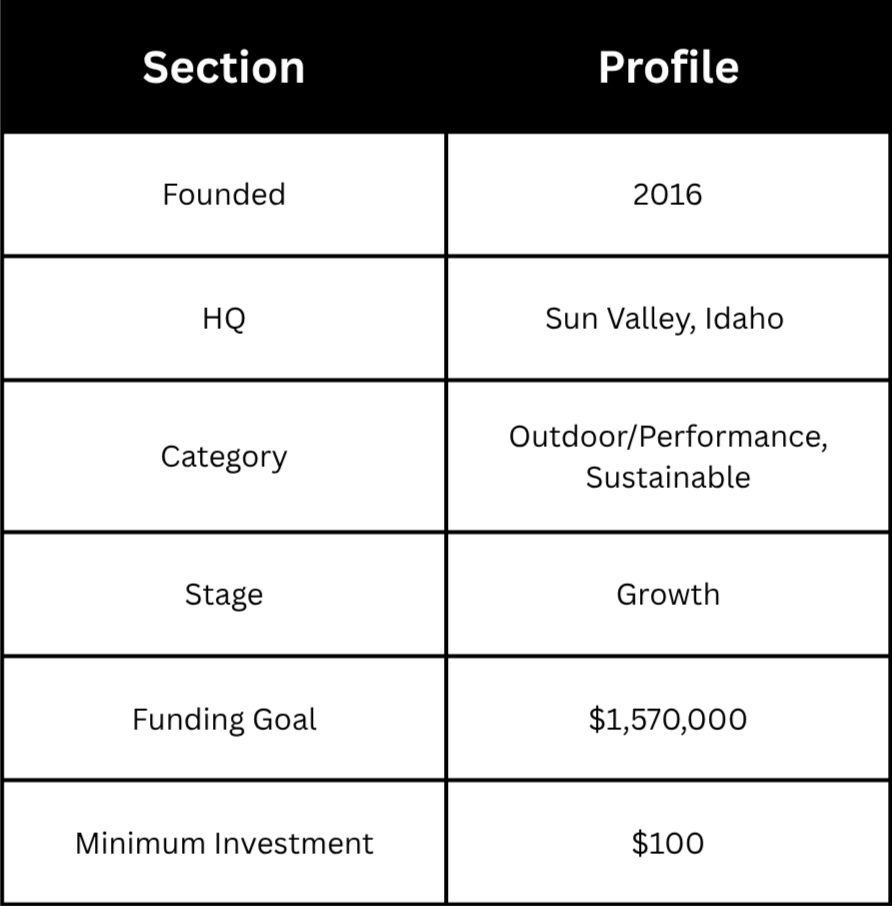

Security Type: Equity (SAFE)

Valuation Cap: $12M

Minimum Investment: $100

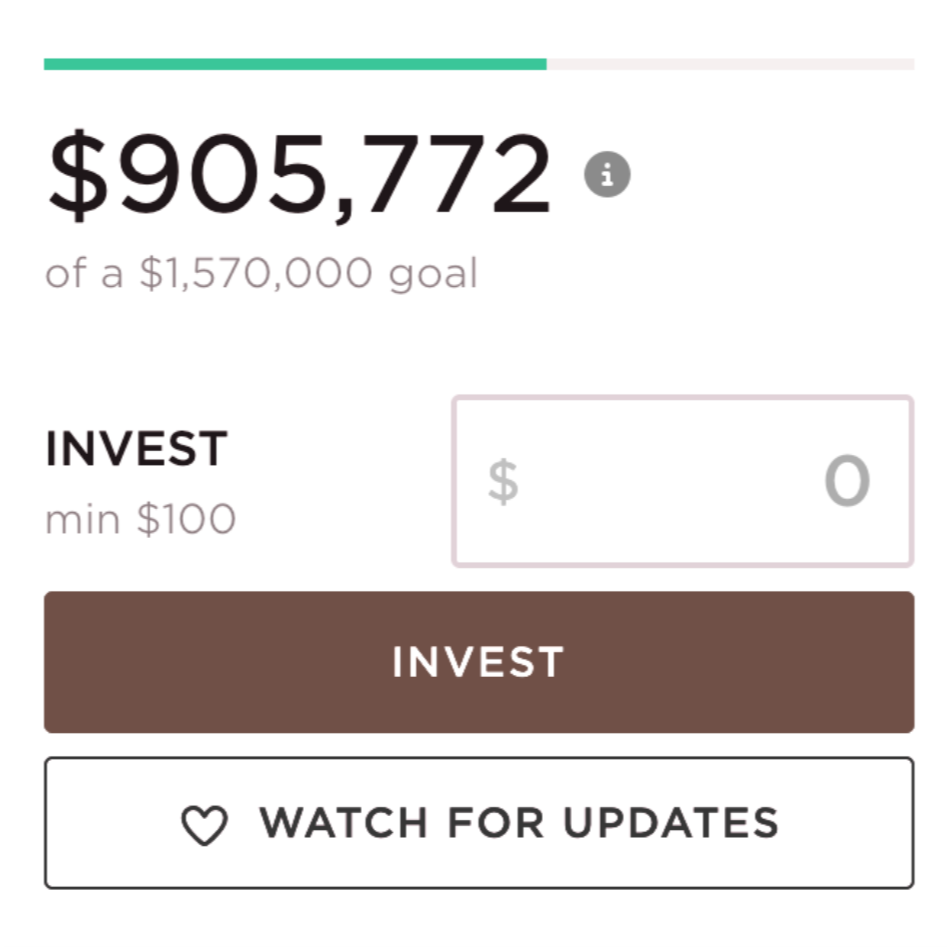

Funding Goal: $1,570,000 (Already raised $1.3M in prior rounds)

Executive Summary

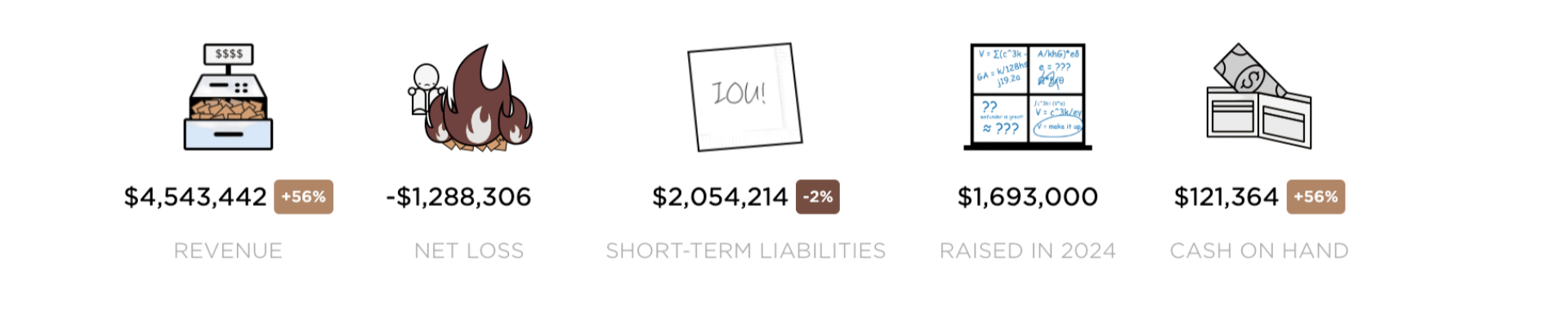

Demonstrated 56% revenue growth (2023-2024)

A 43% repeat customer rate (significantly above industry average) and distribution in 300+ retail doors including REI

Healthy 55% Gross Margins and a scalable DTC first (61% of revenue) model

$1.6M capital raise to fund marketing (50%), product development (20%), and operational scaling to achieve profitability by 2027

The Opportunity: A Massive, Underserved Market

26 Million women in the US ride or ski

85%

Women control 85% of discretionary spending

The Problem: The outdoor industry has long ignored women, "shrink-it-and-pink-it" men's gear. This doesn't work. Women need specific materials, thoughtful sizing, and technical features designed for their bodies.

The Solution: Wild Rye. We never compromise on fit, performance, or style. 63% of our customers choose us because we’re women-led. They stay for the product and the purpose.

46%

Women make up 46% of outdoor recreators, yet run only 4% of cycling brands and 16% of outdoor brands.

200%

Women spend 200% more on apparel than men

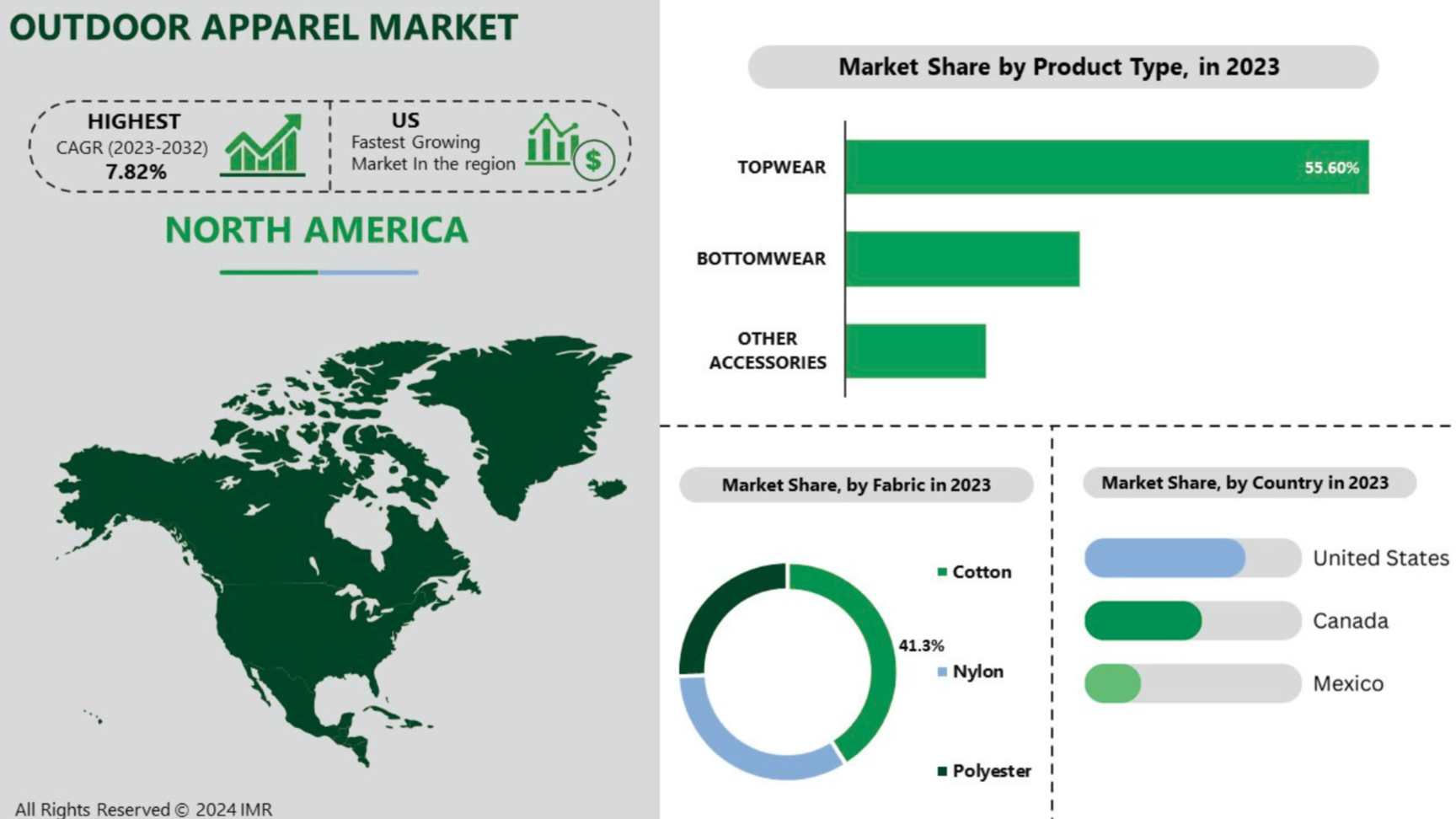

Total Addressable Market (TAM): The US women's cycling & ski apparel market is worth $3.8B today, part of a global outdoor apparel market projected to hit $66B by 2032.

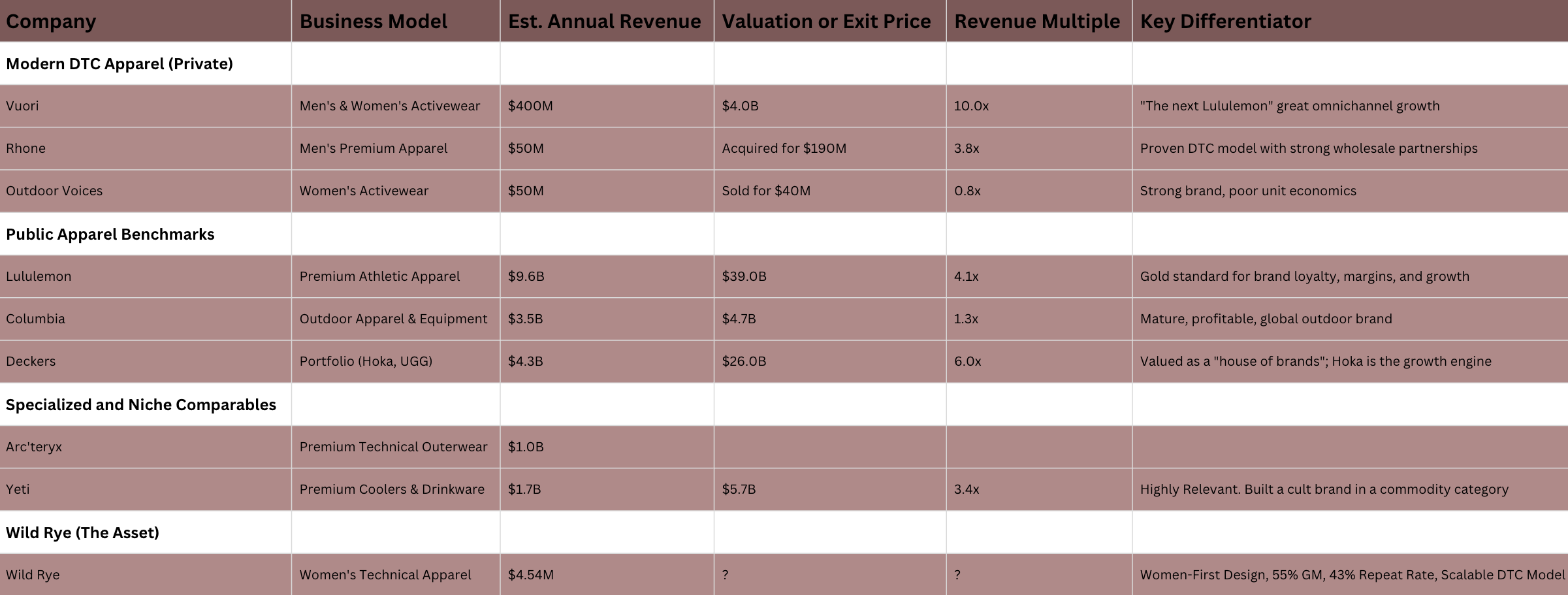

Comparable Company Analysis

Note: Deckers and Yeti are included as they exemplify how a strong brand narrative and community can command premium multiples, even outside pure apparel

Implied Valuation: Using a conservative 2x - 4x revenue multiple (based on comps and growth rate), Wild Rye's implied valuation range is $9M - $18M

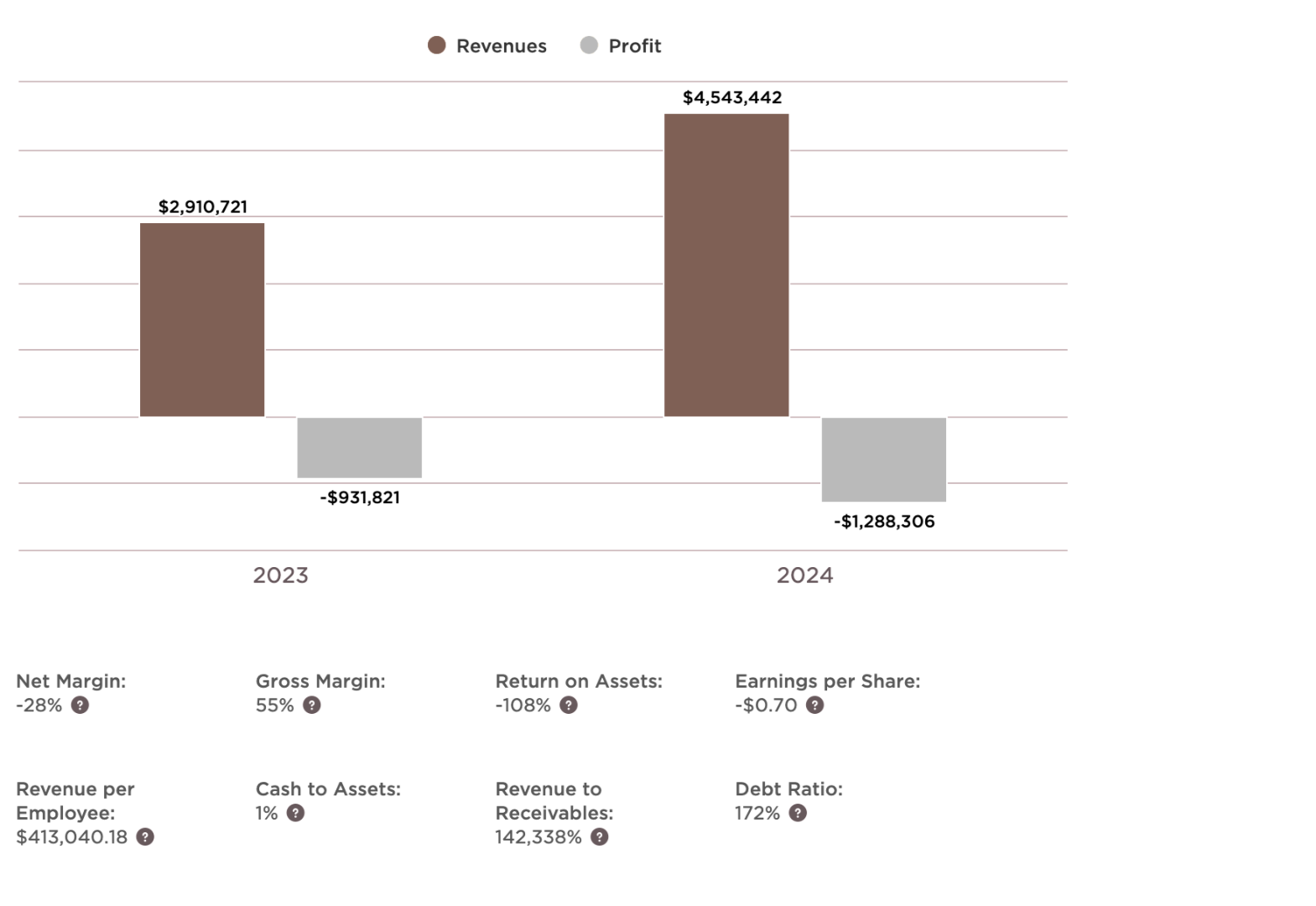

Traction & Financials

We analyze Wild Rye using the same KPIs as a SaaS or tech startup.

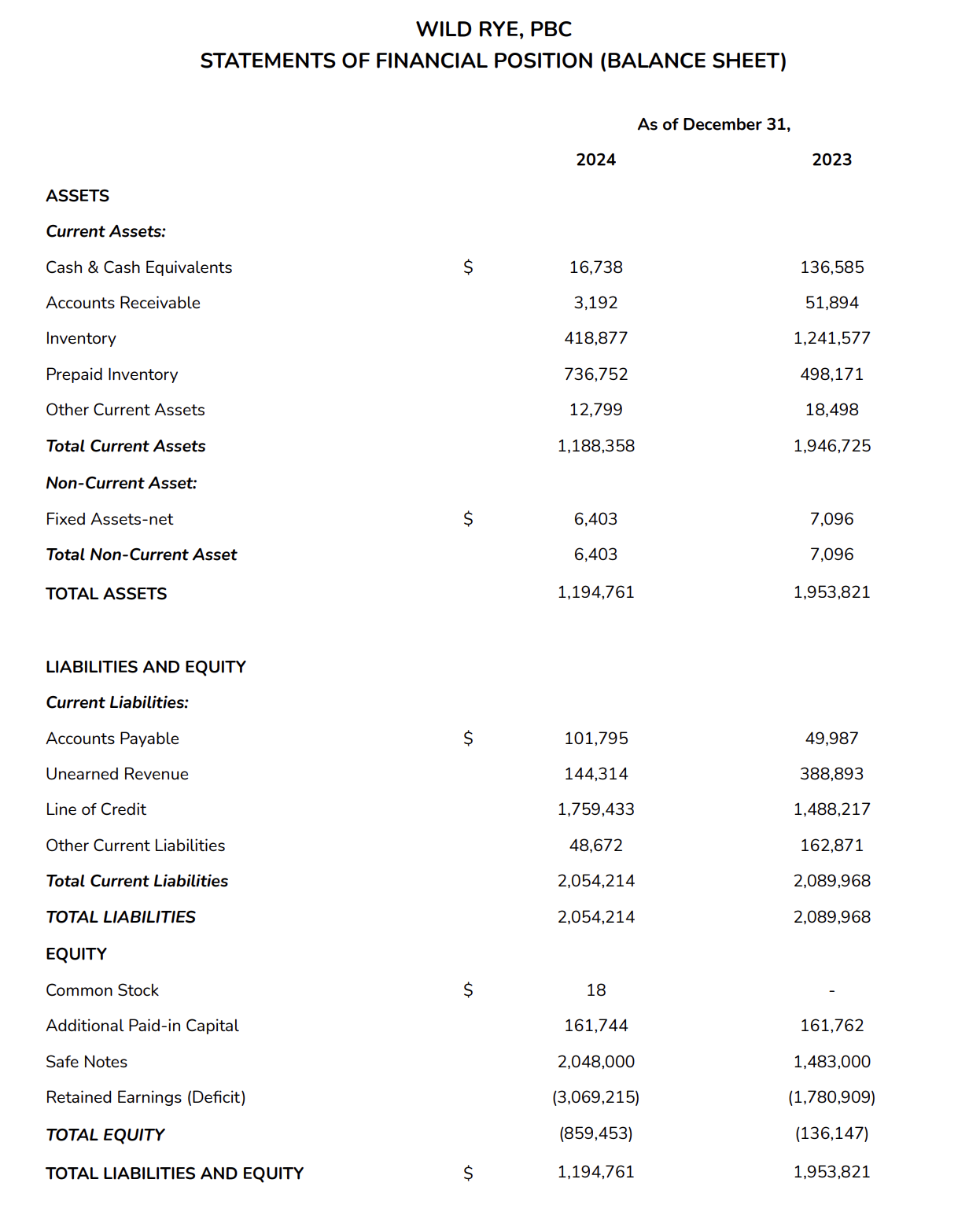

Balance Sheet:

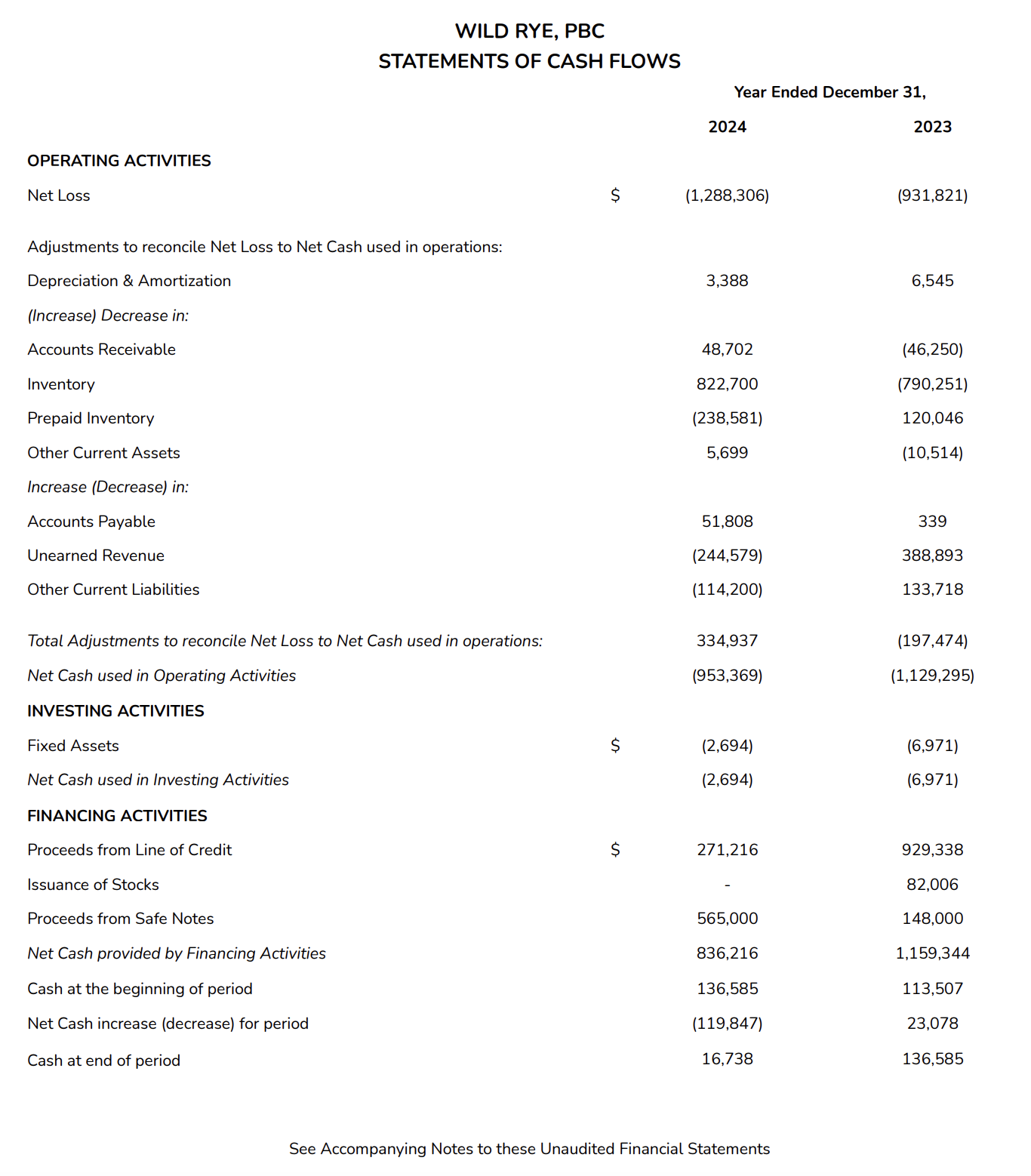

Cash Flow:

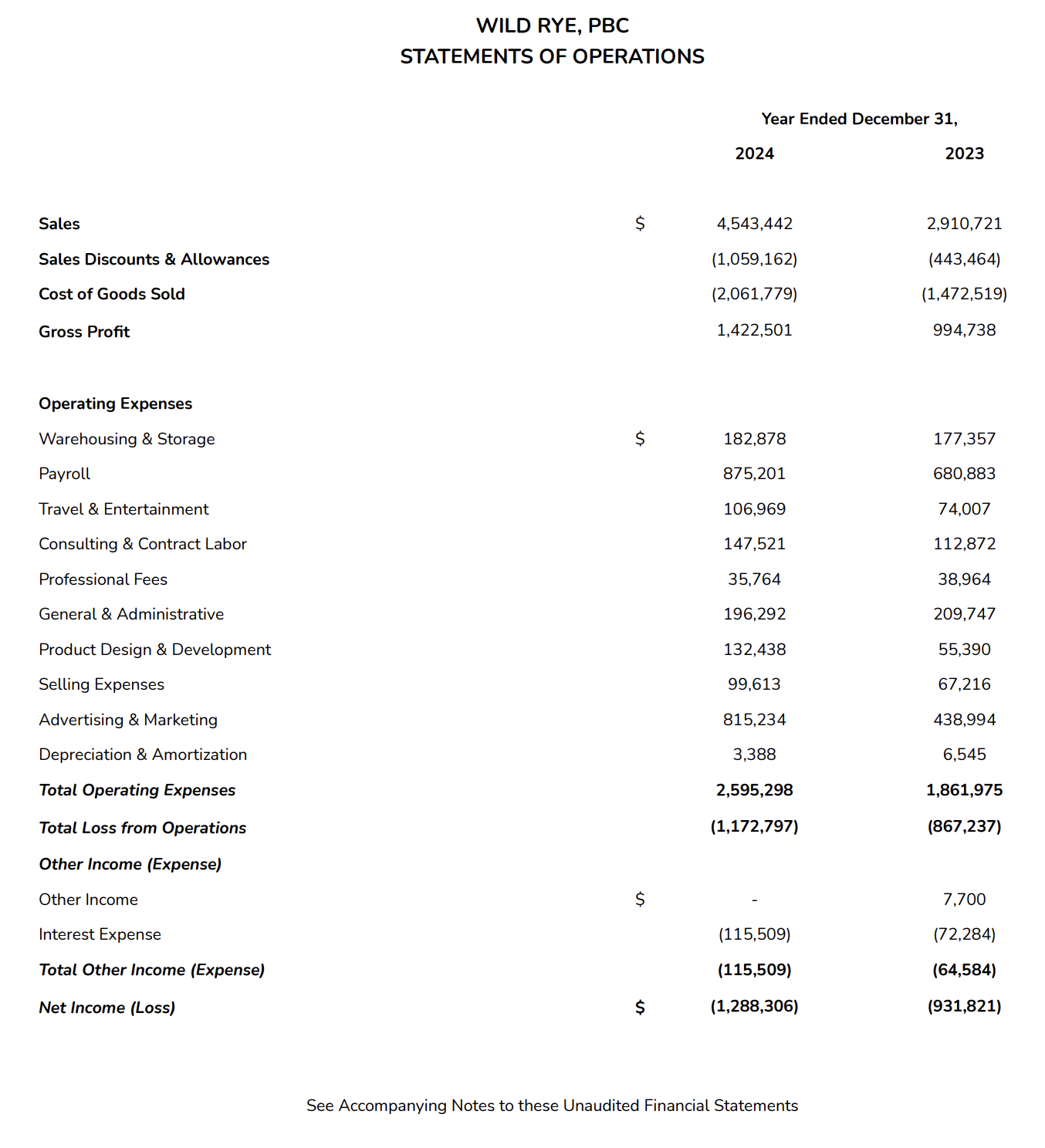

Statement of Operations:

Valuation Frameworks

Applying standard VC frameworks

Venture Capital Method (Pre-Money Valuation)

Target Return: Investor requires 10x return on a $2M investment in 5 years ($20M return).

Projected Exit Valuation: Using a conservative 2.5x revenue multiple on 2029 projected revenue of $18.8M = ~$47M Exit Valuation

Post-Money Valuation Today: $47M Exit / 10x Target Return = $4.7M Post-Money

Pre-Money Valuation: $4.7M Post-Money - $2M Raise = $2.7M Pre-Money

This is a baseline. The high growth rate and gross margin justify a higher multiple, thus a higher pre-money valuation

Benchmarking Against Comps (See Section Above)

A 3x revenue multiple on 2024 revenue of $4.54M suggests an estimated $13.6M Pre-Money Valuation

This framework is often most relevant for later stage, proven companies like Wild Rye

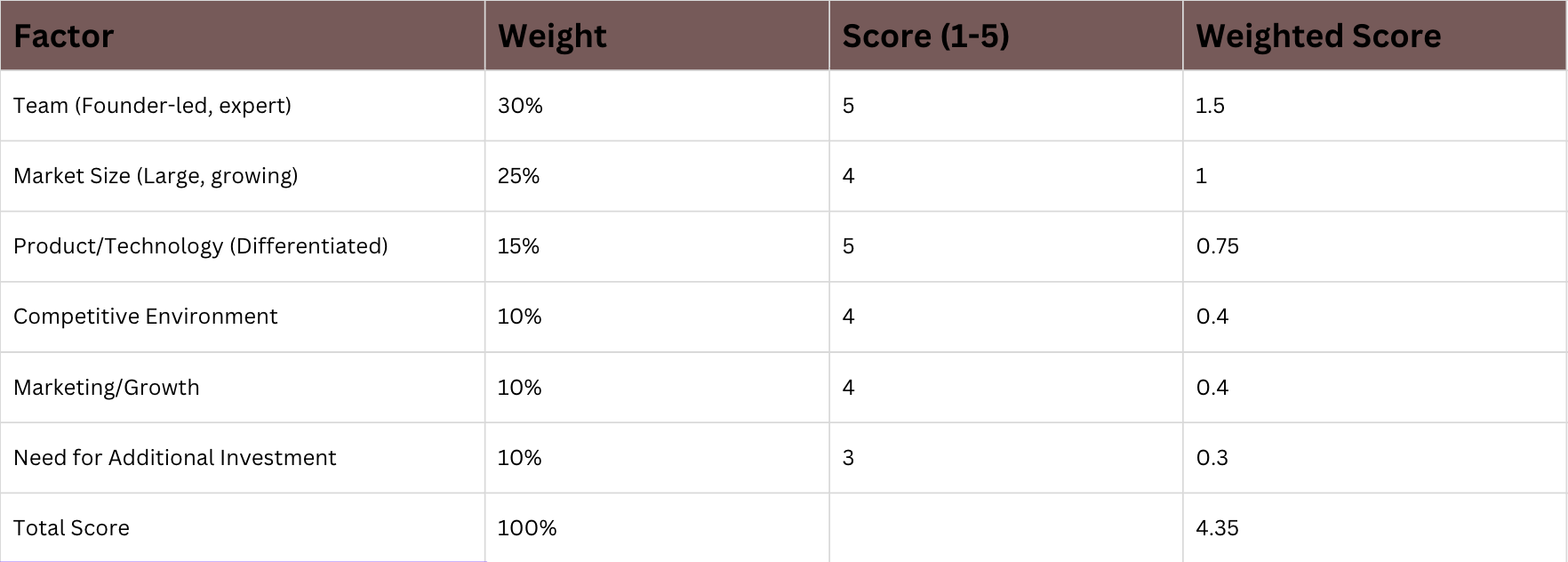

Risk-Adjusted Scorecard Method

This method values the company based on the strength of the team, product, and market against early-stage benchmarks. Wild Rye scores highly, justifying a premium

If the average pre-money valuation for a seed-stage company is $6M, a score of 4.35/5.0 suggests a pre-money valuation of $8M - $10M.

Risk Mitigation & Investment Rationale

Liquidity and High Leverage

The $2M equity raise directly addresses the cash problem and reduces reliance on the high interest line of credit. Founder's $500k loan demonstrates extreme confidence.

Path to Profitability

With 55% GM, the model is inherently profitable. The current net loss is a strategic choice to fuel growth. A slight reduction in Marketing burn (as recommended) could accelerate breakeven

Supply Chain and Tariffs

Management is already proactively renegotiating manufacturing as production exits China, showing operational agility

Category Expansion

Plan to "delay non-core category launches until profit" is a prudent, investor-friendly strategy that focuses on capital efficiency

Invest Now

Take a minute to write an introduction that is short, sweet, and to the point. If you sell something, use this space to describe it in detail and tell us why we should make a purchase. Tap into your creativity. You’ve got this.