Education Hub

*Updated on a weekly basis*

Demystifying Fashion Startups as a Modern Asset Class. Learn the frameworks, metrics, and strategies for investing and entrepreneurial success

The New Fashion Asset Class

Discover how fashion is evolving into a legitimate investment category, combining creativity with capital and redefining how value is measured in the industry

Financial Literacy

Gain insights into the fashion sector’s potential, explore emerging opportunities and learn how to evaluate creative ventures through structured financial frameworks

For Investors

Access tools and guidance to prepare your brand for investment, from developing business plans and pitch decks to understanding investor expectations

For Entrepreneurs

Learn how to assess and communicate the financial value of a fashion startup using metrics, risk models, and real world case studies tailored to the industry

Case Studies

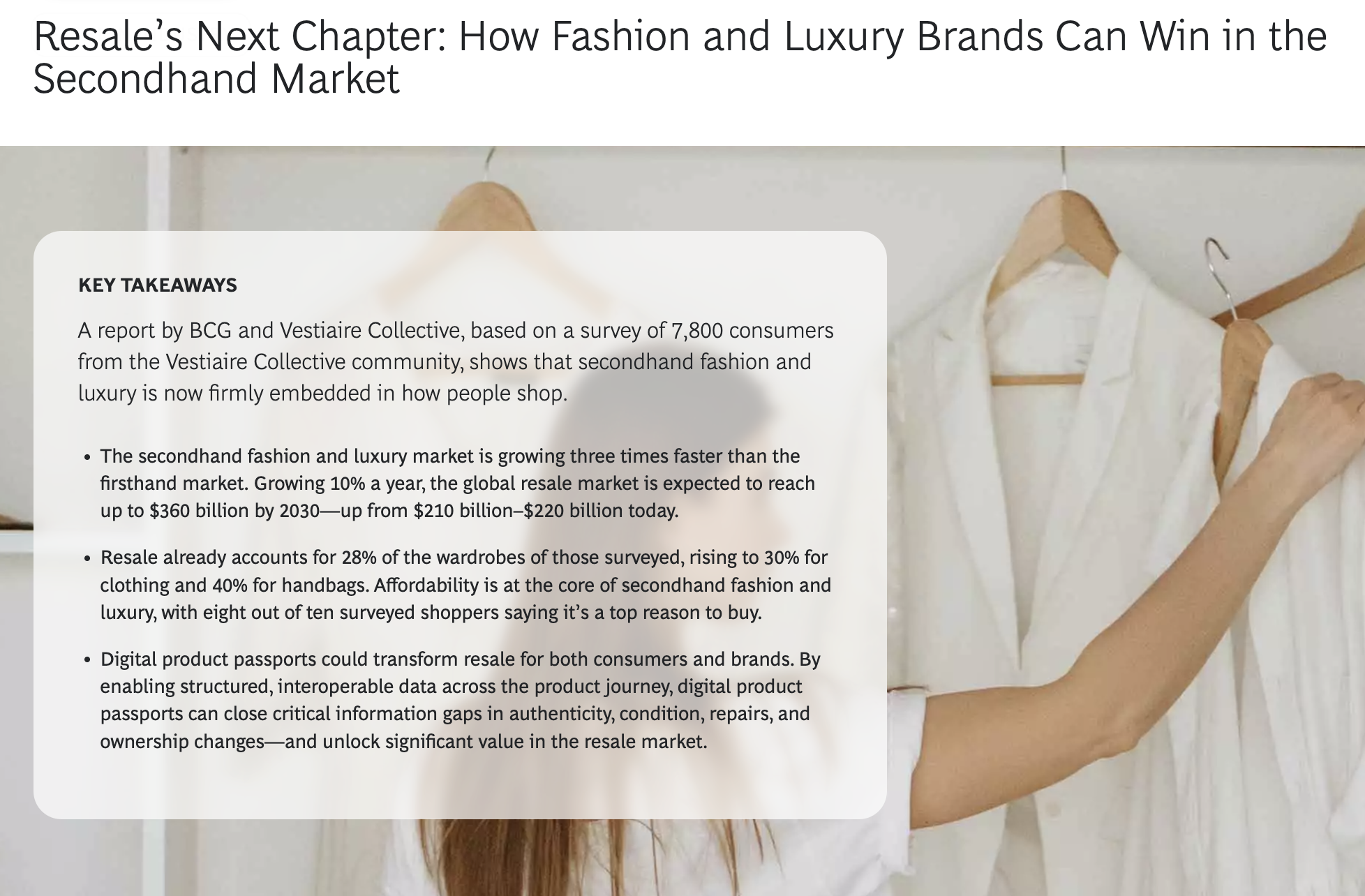

Explore curated links, articles and guides designed to deepen your understanding of fashion finance, entrepreneurship, and sustainable business growth

Additional Resources

Build your financial confidence with accessible lessons on budgeting, capital management, funding structures and investment terminology for creative professionals

The New Fashion Asset Class

Infographic: The Anatomy of a Fashion Unicorn

Gen Z’s shift towards alternative asset classes: Investors prioritizing diversification

Beyond the Runway: Why Fashion Startups Are the Next Venture Capital Frontier

A16z Podcast: Making Culture, Making Influence

Why sustainable fashion could be in style for responsible investors - AXA

Financial Literacy Tools

Glossary: Reason Street Capital Library

VC Relations: Stages of Venture Capital

Unit Economics Explained - Margin Medics

Check out the first part of our Video Clinic series on Unit Economics for founders, operators, and all those seeking to improve their profitability. In this episode we walk you thru the basics, common mistakes, and lastly how to conduct a thorough unit economic analysis of your business. Think of it as a Unit Economics 101 class taught by a startup finance guy and operator that have spent the last decade in the trenches.

The Business Model Canvas - Strategyzer

Startup Experience : Market size estimation & Unit economics

Lauri Kokkila from Inventure shares insights on:

1. How do VCs evaluate startups?

2. Market potential (VC math)

3. How to calculate market size both top-down/ bottom-up approaches

4. Unit economics

Strategyzer Webinar: Value Proposition Canvas

The Value Proposition Canvas helps you design products and services that customers really want because it gets you to focus on what matters most to them. You won’t find success with the tool though if you don’t learn how to use it properly. In this session, Strategyzer co-founder Alex Osterwalder walks you through key best practices and techniques for getting the most out of the tool.

For Investors

Guide to Performing Due Diligence in VC

“Startup Valuation: How Venture Capitalists Value Early-Stage Companies”

“How to Value Your Early-Stage Startup

Evaluating & Valuing Startups

“The Financial Playbook for Fashion Startups: What Investors Really Want to Know”

For Entrepreneurs

Pricing: Michael Dearing on Managing Pricing

Entrepreneurship Essentials (E2) - Customer Discovery with Melissa Byrn

Join Melissa Byrn, Assistant Dean for Clinical Research at UChicago, for a workshop that gives an overview of the customer discovery process. During this workshop, you will learn techniques for facilitating customer discovery interviews, which will help you understand your future customers’ values, pain points, and current solution(s). This process is critical to ensuring that your product or service will be adopted by your customers when it hits the market.

Strategy For Startups - Harvard Business Review

Budgeting with Start Up Boston

In today’s fast-paced startup ecosystem, effective financial planning is essential for navigating uncertainty and seizing growth opportunities. This presentation will help you strategically plan your startup's budget, giving you a clear game plan for managing cash flow and allocating resources to ensure sustainable growth.

How to acquire your first 100 customers - Asia Orangio, Founder of DemandMaven

Testing Business Ideas with David Bland - Summer Startup Series

Building on the best selling Strategyzer books, David J Bland and Alex Osterwalder curated a list of experiments for people who are stuck Testing Business Ideas. They identified three major themes from design thinking and applied them to rapid experimentation. Desirability describes whether or not people want the solution. Viability addresses if you can create a sustainable business with the solution. Feasibility dives into the steps to run the infrastructure. In this talk, David will describe the principles behind Testing Business Ideas and facilitate an interactive session on sequencing experiments.