WHY FASHION?

WHY FASHION?

We've Heard the Skepticism.

The problem isn't the risk. It's the outdated perception.

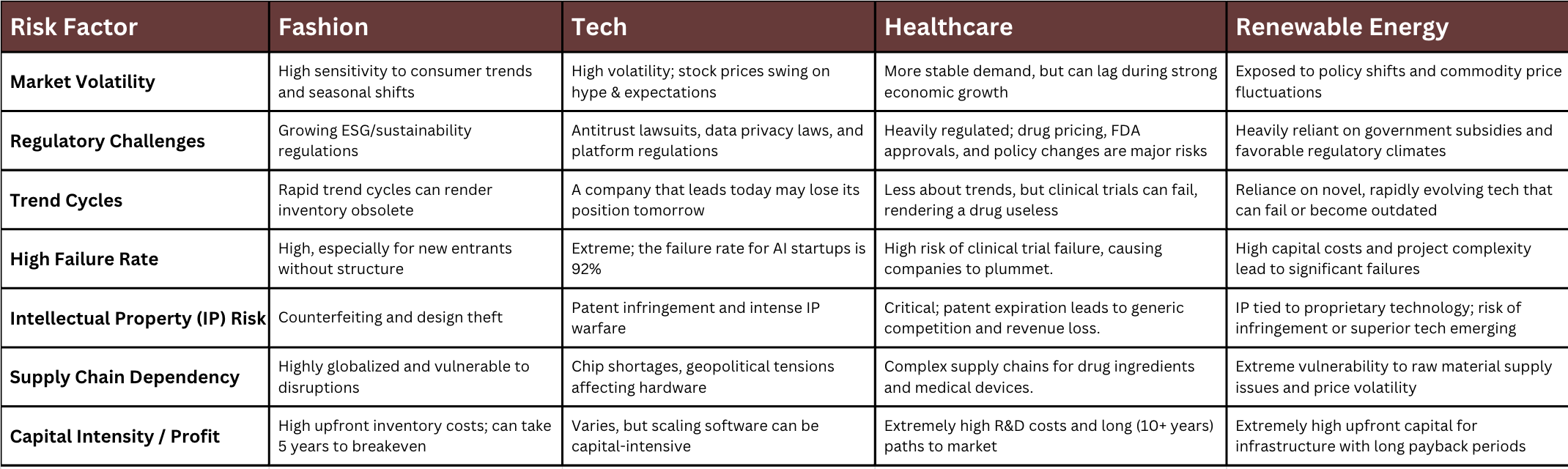

Industry Risk Comparison

“Fashion is too risky and volatile”

So is Tech and Biotech. A 92% failure rate for AI startups is well-documented, yet capital flows in aggressively. The difference is that tech has a structured language for discussing risk and reward. Fashion's risk is not higher, it's just less understood.

“It's based on fleeting trends, not stable demand”

Trends are a feature, not a bug. They represent a predictable, recurring consumer demand for 'newness.' The most successful modern brands aren't just chasing trends, they are using data analytics to anticipate and lead them, turning volatility into a managed strategy

"It's an unstructured, relationship driven industry"

That was the old model. The new model is built on transparent, standardized metrics. The lack of structure is precisely the gap we fill. We provide the framework that makes fashion as legible as a SaaS business.

"I don't know anything about it, so I avoid it"

This is the most common and valid barrier. Our platform demystifies the industry. We act as your expert guide, providing the due diligence, standardized KPIs, and vetted opportunities that allow you to invest with the same confidence you have in your core domains

Fashion's Inherently Investable Traits:

Tangible Intellectual Property (IP) & Brand Value

Fashion brands are built on defensible assets: trademarks, design patents, and brand equity. These are legal assets that can be valued and appreciate over time, just like a patent portfolio in tech.

The Data Advantage of Modern Brands

Direct-to-consumer (DTC) fashion brands are, at their core, data companies. They own rich customer data on demographics, lifetime value (LTV), and buying habits. This data is a hugely valuable, quantifiable asset that allows for predictable scaling.

“Fashion retailers leveraging analytics are outperforming their competition by 68%”

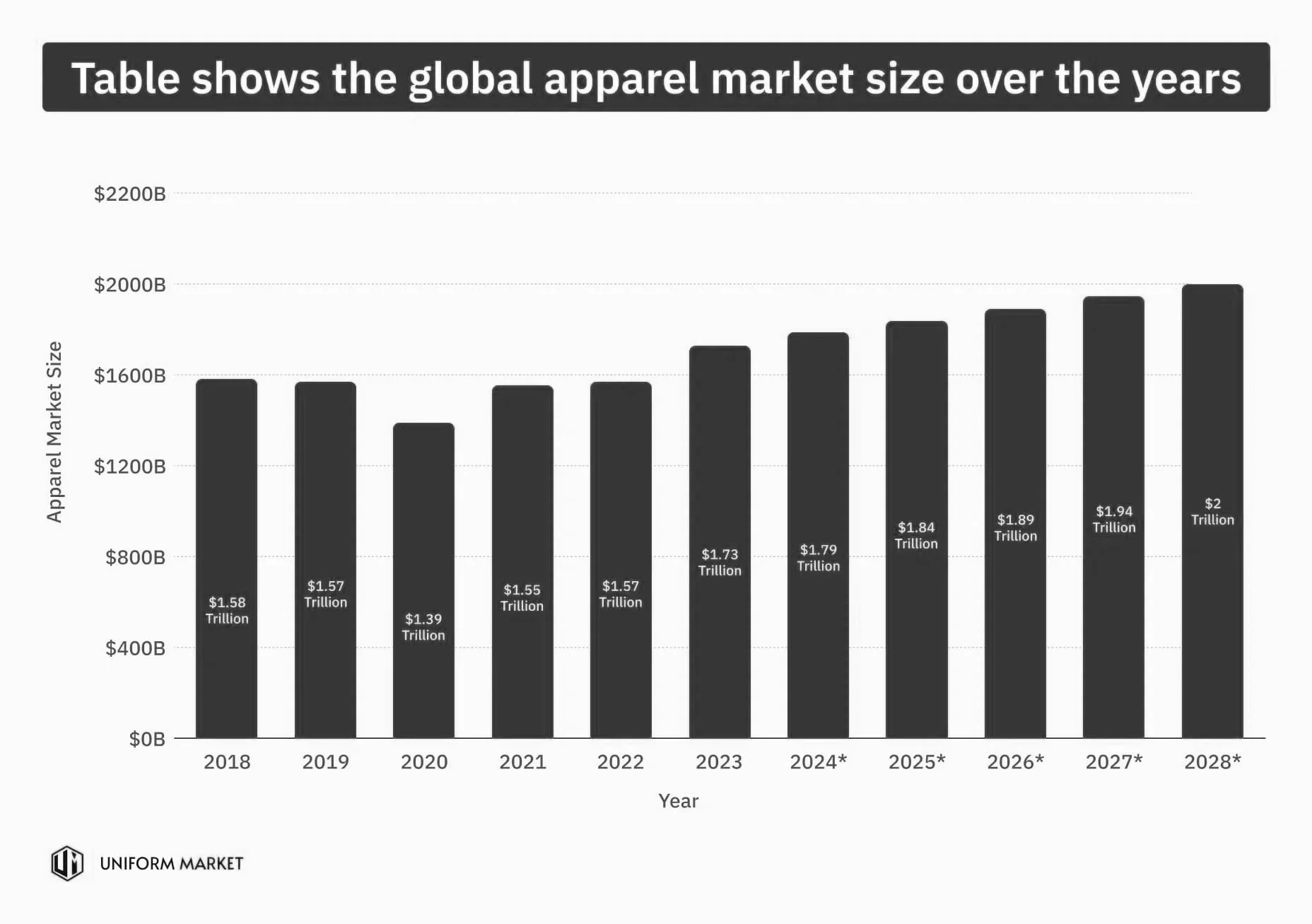

Proven Profitability & Market Size

This isn't a niche or a passion project, it's a $2.5 trillion global industry. Established fashion players demonstrate resilient, steady profitability, proving the underlying business model is sound.

1. Data shows that established fashion companies maintained a weighted average net profit margin of +4.7% over five years, showing stability even during the economic turbulence of COVID-19

2. For early stage and small brands, the business model is inherently profitable. Real world data indicates that fashion businesses can achieve average gross margins as high as 47%

3. The brands that succeed are those leveraging technology. Fashion retailers who use advanced analytics and AI-driven decision making are outperforming their competitors by 68%

The Unique Value Proposition:

Diversification & Low Correlation

Fashion cycles are often independent of tech or energy market cycles. Adding fashion to a portfolio provides a unique diversification benefit, insulating you from sector specific downturns

The Impact & Values Alignment

Modern investors, especially younger ones, seek to align their capital with their values. Fashion is at the epicenter of the sustainability revolution, circular economy, and ethical manufacturing, all high growth areas

“fashion startups with provable sustainability technology raise at higher valuations”

The "Cultural Asset" Parallel

Investors already accept the value of subjective, culturally-driven assets like art, music royalties, and collectibles. Fashion is the next logical frontier in this alternative asset class, offering both financial and cultural returns.

Solution

The perception of fashion as 'uninvestable' is a structural and informational problem, not an inherent flaw in the industry. Moda Fund solves this by providing the rigorous due diligence, standardized metrics, and secure framework that transforms cultural ventures into credible assets. We've built the bridge so you can confidently access this untapped opportunity.